Employees expect compensation for high inflation

Live recruitment market data to help you make decisions

A 60 second snapshot to take the temperature of professionals in FinTech, Financial Services & DeFi – delivering data and insight to help you make decisions.

It seems like you can’t turn on the radio, flick through social media, read a newspaper or watch the news without constantly hearing about inflation. We have noticed an increase in prospective candidates looking for more than ‘normal’ salary increases when considering new opportunities and anecdotally, this is due to the increasing cost of living.

We were wondering how people felt about the situation and whether employers should compensate for the current inflationary environment.

As always, our polls cover all levels and both technology and non technology roles. We received 897 responses across FinTech, Traditional Financial Services and DeFi and our results are broken down into:

- Executive (VP, Director, Head of Function, CXO, etc.)

- Non Technology (operations, corporate services, sales, risk, compliance, etc. below Executive Level)

- Technology (all areas of technology from build to test below Executive Level)

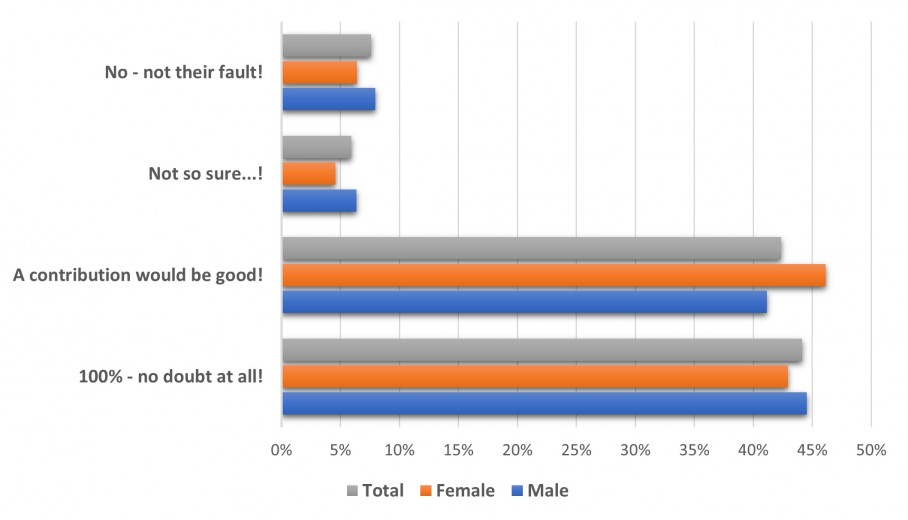

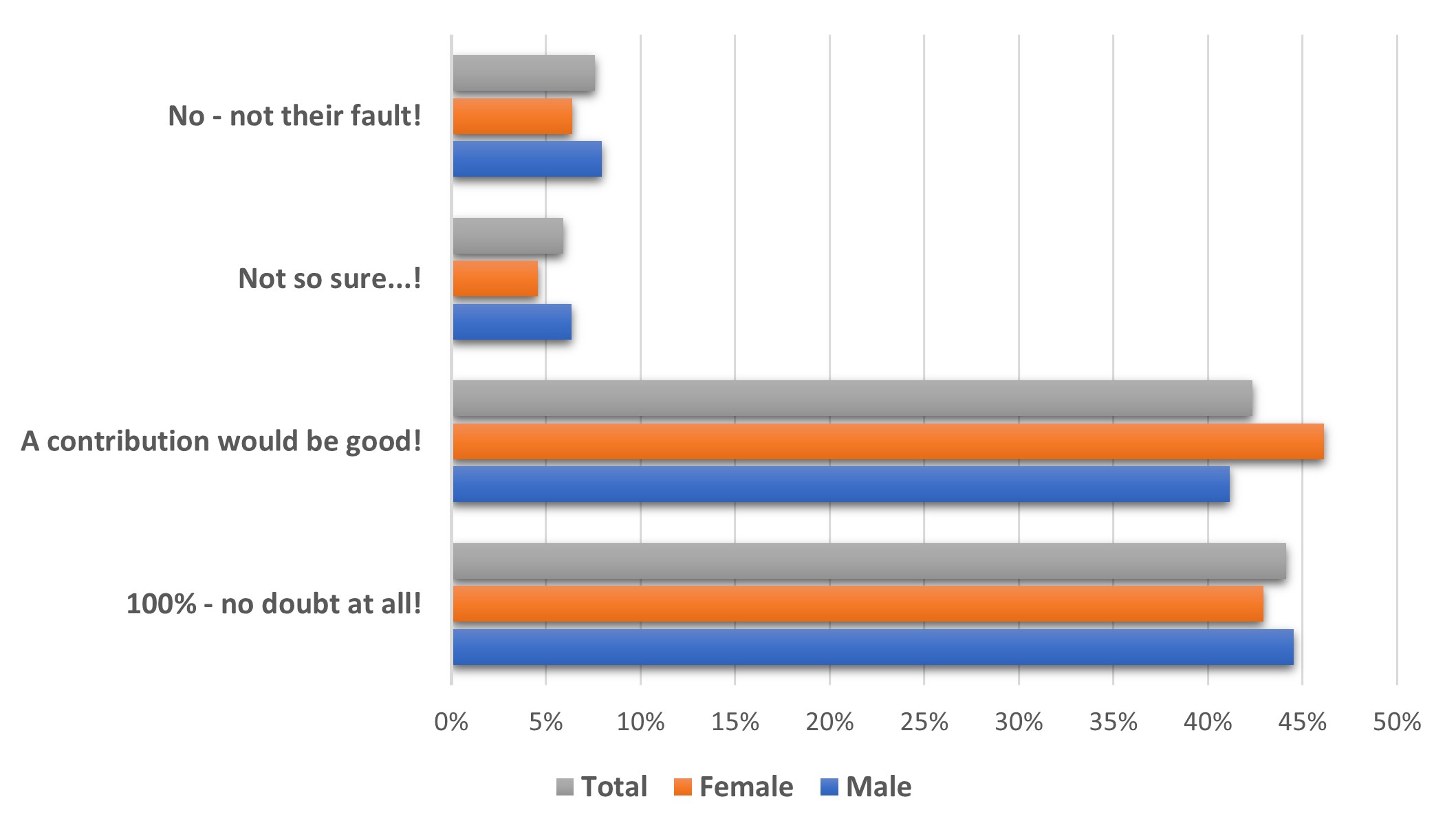

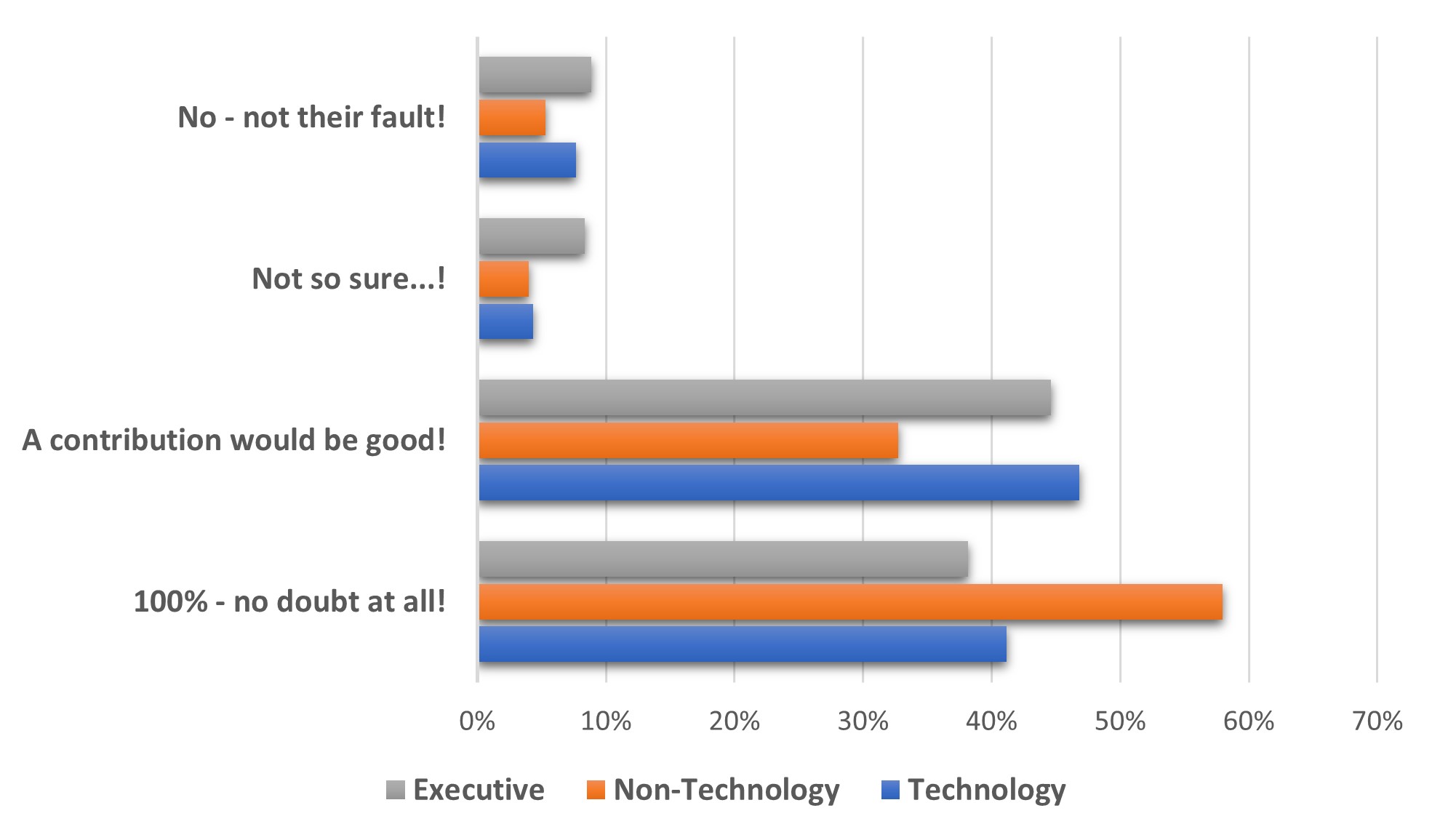

This week we asked:

“My employer should compensate for current high inflation?”

The Results

By Sector/Level

Key take aways?

- The sentiment is clearly toward the employer making some contribution toward high inflation

- This is strongest among junior to mid level ‘non-technology’ professionals

- Executive level shows the most conservative opinion but still strongly toward employers making a contribution

What can you do?

- The obvious solution is some form of compensation – off cycle pay review, one off bonus, benefits increase, etc.

- Communicate – companies are being hit with increased costs also and the wider economic environment is uncertain, making contributions toward this problem may not be an option and leaders need to hold a strategic, long term view making decisions for the long-term benefit of the business (and ultimately staff)

- Get creative – are there any low or no cost things that can be done – additional work from home days to reduce transport costs, arrange a talk on financial planning, highlight already available but underutilised benefits (a lot of corporate health plans will include access to EAPs for example)

- Keep your finger on the pulse – are you seeing an uptick in turnover or absenteeism – this may be a cause and the cost of recruitment is higher than the cost of retention so it may make financial sense to act early

We are asking weekly questions to our pool of professionals to give you live market info to help making decisions.

Check out our recent surveys including:

- How will talk of recession impact the recruitment market?

- If I was told to come back to the office 5 days per week I would…

If we can help solve any of your talent headaches – get in touch – paul@ttrmail.com